Traction Fund backs Enterprise startups picked by their customers

Traction Fund is a venture capital syndicate backing early and growth-stage startups in professional services, financial, and technology sectors picked by Executives from these industries.

The Enterprise Software:

The Next Trillion-Dollar Frontier

The Next Trillion-Dollar Frontier

Enterprise software is the next trillion-dollar frontier, driven by rapid advancements in Generative AI and related technologies. Today it is ripe for founders and venture capital investment.

Yet, most founders and investors fail the quest as they don’t know how to navigate the B2E complexities such as creating tailored solutions, passing stringent security standards, and managing long procurement cycles.

Yet, most founders and investors fail the quest as they don’t know how to navigate the B2E complexities such as creating tailored solutions, passing stringent security standards, and managing long procurement cycles.

Startups backed by Traction Fund have access to turn-by-turn guidance from Traction Club members and are able to capitalize on B2E’s long-lasting benefits:

Competitive barriers

Multiyear contracts

Long product lifetime

Low Churn

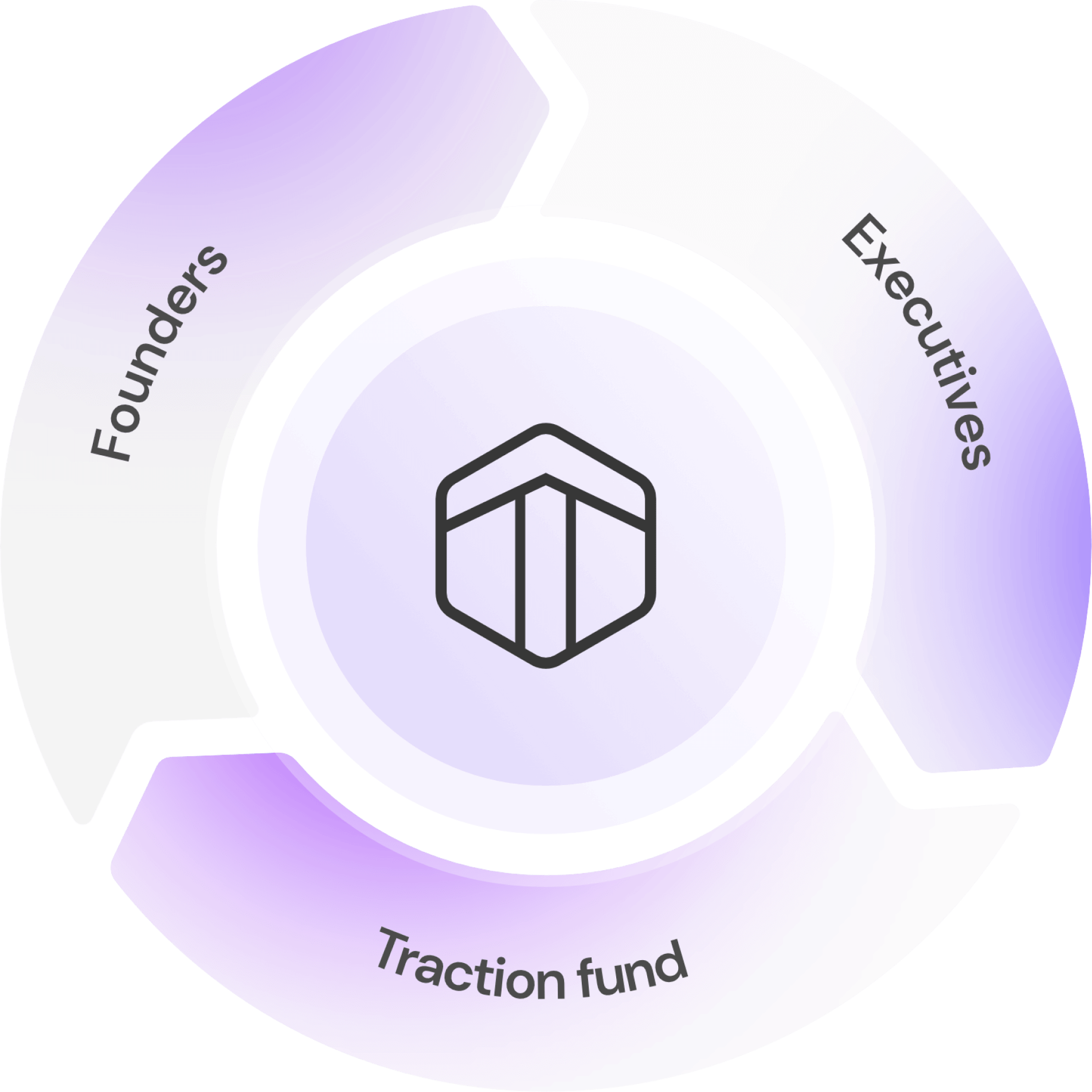

Traction Club

At its core, Traction Club is a close-knit group of the innovative executives from professional services, financial, and technology companies who are guiding B2E startups in their journey.

By facilitating meaningful engagements between such executives and promising startups, Traction Club enables startups to rapidly achieve product-market fit and scale based on direct feedback from their future buyers.

By facilitating meaningful engagements between such executives and promising startups, Traction Club enables startups to rapidly achieve product-market fit and scale based on direct feedback from their future buyers.

50+

Traction Club has already grown several companies from scratch to 50+ clients, each in legal, banking, and insurance.

Traction Club is beneficial to all involved parties

Executives hold the founders focused on the product roadmap while ensuring the products are reliable and compliant.

Founders get insights directly from future buyers and happy customers for reference calls.

Traction Fund gets an opportunity to invest in the most promising companies.

Executives hold the founders focused on the product roadmap while ensuring the products are reliable and compliant.

Traction Fund gets an opportunity to invest in the most promising companies.

Founders get insights directly from future buyers and happy customers for reference calls.

Where do we invest?

Follow-ons

We actively double down on our current portfolio companies.

Seed Stage: up to $500k

We back one U.S. startup at the incubation/seed stage a year with up to $500k.

Growth Stage: up to $5M

We invest up to $5M in 1-2 enterprise startups at the growth stage a year.

Where do we invest?

Follow-ons

We actively double down on our current portfolio companies.

Seed Stage: up to $500k

We back one U.S. startup at the incubation/seed stage a year with up to $500k.

Growth Stage: up to $5M

We invest up to $5M in 1-2 enterprise startups at the growth stage a year.

How is our Seven Sieves Selection process different

The Investment Process at Traction Fund starts with top-of-the-funnel leads referred by the Traction Club and our broader network. Each opportunity then undergoes a thorough evaluation through our unique Sieve process.

Traction Club & Broader network leads

Consensus of Product Buyers

Exit Options Probing

Data room analysis

Milestones sanity check

Risk/Return Evaluation

Investment Decision

Consensus of Product Buyers

Exit Options Probing

Data room analysis

Milestones sanity check

Risk/Return Evaluation

Investment Decision

Traction Club & Broader network leads

Consensus of Product Buyers

Exit Options Probing

Data room analysis

Milestones sanity check

Risk/Return Evaluation

Investment Decision

Investing Right Amount. At the Right Time.

Once a company passes the filter, we back it immediately using the anchor capital. Next, we secure additional capital from our network of syndicates and family offices to double down.

We aim to become and remain a major investor getting the rights, preferences, and the Board presence.

We aim to become and remain a major investor getting the rights, preferences, and the Board presence.

How do we invest?

- immediate sizeable contribution,

- access to our network of executives,

- a sophisticated point of reference on calls with VCs

- access to our network of executives,

- a sophisticated point of reference on calls with VCs

Why do founders love us?

Our Investors benefit from:

Access to investment opportunities picked by product buyers

Being treated as a major investor’s LP with all respective rights

Because Traction Matters

Real-time insights on product performance in client environments

Various exit opportunities to fit co-investors’ return horizon

Portfolio

The company became profitable since the investment and crossed an estimated ~$500M in revenue preparing for the IPO.

Automation Anywhere is a Leader in Enterprise Robotic Process Automation (RPA). Automation Anywhere creates virtual workers that mimic repetitive human processes, saving hard and soft dollars for Fortune 1000 clients.

Profitable

the company became profitable since our investment

~$500MM+ ARR

the estimated recurring revenue

Trax Retail is a Leader in real-time analytics for retail stores. Trax Retail provides cloud-based retail management solutions to CPG brands and retail stores using advanced computer vision and artificial intelligence. The product line includes shelf monitoring and optimization, retail execution optimization, market measurement and strategy, store management, and signal-based merchandising.

Adj. EBITDA-positive (since our investment in 2021)

Adj. EBITDA-positive (since our investment in 2021)

Hercules.ai is a developer of multi-agent Generative AI solutions that optimize enterprises’ back offices.

They provide fine-tuned Generative AI apps to legal, banking, and insurance enterprises. Back-office optimizations help companies capture new revenue and save up to 2% of the top-line revenue.

8X

Valuation growth

since seed investment

since seed investment

120X

Revenue growth

ECFx is a universal communication hub between US courts and court users.

The company removes friction and saves each litigation-heavy client - law firms, insurance companies, and government agencies - up to $15M in hard cash expenditures a year by creating Electronic Court Filing Experience (ECFx).

4X

Valuation growth

since seed investment

since seed investment

60X

Revenue growth

CloudBees is a software company that specializes in providing enterprise-level solutions for software development, mainly focusing on DevOps and continuous integration/continuous delivery (CI/CD) processes.

We see CloudBees among the beneficiaries in case of the upcoming regulatory scrutiny of the IT industry.

We see CloudBees among the beneficiaries in case of the upcoming regulatory scrutiny of the IT industry.

1.8X

Valuation Growth

(since our pre-Series F investment in Nov’2021)

(since our pre-Series F investment in Nov’2021)

1.6X

Revenue growth

(since our investment)

(since our investment)

Hercules.ai is a developer of multi-agent Generative AI solutions that optimize enterprises’ back offices.

When we invested: For the first time, we invested in 2018 during their Seed, skipped overpriced Series A, and doubled down in attractively priced Series B, becoming a major investor.

Why we invested: Traction Club has supported the company since entering regulated industries in 2018. At the time of seed investment in 2018, we liked that the company could build AI products on edge when only a handful of companies could.

By the time of Series B, the company had taken over the legal market and started expanding into banking and insurance, with five products each reaching product-market fit. All the products were built on the proprietary stack of small-sized models showing the highest accuracy on the market and ran on customers’ premises.

Valuation growth 8x since seed investment, revenue growth 120x

ECFx is a universal communication hub between US courts and court users.

When we invested: We invested in 2021 during their Seed raise after Traction Club Partners piloted the company’s solution and eventually signed a contract.

Why we invested: Traction Club has supported the company since it graduated from Denton’s accelerator in 2020. Industry veterans from Thomson Reuters founded the company; the founding team had the right mix of necessary backgrounds, a deep understanding of the industry and its problems, capabilities to solve them, and well-developed personal brands.

The founders came across as coachable, iterating, and resource-savvy, with a clear vision for the company they have been executing since then. Traction Club’s sign-off indicated that their product is a “must-have” for litigation-heavy firms.

The founders came across as coachable, iterating, and resource-savvy, with a clear vision for the company they have been executing since then. Traction Club’s sign-off indicated that their product is a “must-have” for litigation-heavy firms.

Valuation growth 4x since seed investment, revenue growth 60x

Automation Anywhere is a Leader in Enterprise Robotic Process Automation (RPA). Automation Anywhere creates virtual workers that mimic repetitive human processes, saving hard and soft dollars for Fortune 1000 clients.

When we invested: We invested in 2021 amidst COVID-19.

Why we invested: The club executives grew fond of the RPA solutions and their perspectives at the time. Automation Anywhere had only one real competitor, UiPath, and has been more attractive as they were cloud-native, more affordable, deployed faster, had a lower learning curve geared towards “citizen developers”, and had IQ Bot for IDP.

Their architecture, unlike UiPath, allowed for both vertical and horizontal scaling of their microservices. The company was led by founders for the second decade, had a global presence, maintained high growth rates, and looked undervalued compared to UiPath.

Their architecture, unlike UiPath, allowed for both vertical and horizontal scaling of their microservices. The company was led by founders for the second decade, had a global presence, maintained high growth rates, and looked undervalued compared to UiPath.

The company became profitable since the investment and crossed an estimated ~$500M in revenue preparing for the IPO.

Trax Retail is a Leader in real-time analytics for retail stores.

Trax Retail provides cloud-based retail management solutions to CPG brands and retail stores using advanced computer vision and artificial intelligence. The product line includes shelf monitoring and optimization, retail execution optimization, market measurement and strategy, store management, and signal-based merchandising.

Trax Retail provides cloud-based retail management solutions to CPG brands and retail stores using advanced computer vision and artificial intelligence. The product line includes shelf monitoring and optimization, retail execution optimization, market measurement and strategy, store management, and signal-based merchandising.

When we invested: We invested in May of 2021 after COVID-19, participating in Series E.

Why we invested: We liked the company’s dominant position in a vast market, large room for growth, continuously improving solutions, and significant contracts with major CPG brands. The founders were also very passionate and clearly aware of what they were doing. The large war chest would also allow them to practice as much as they wanted. We also verified the availability of multiple exit options before investing.

The company has kept growing and became adjusted EBITDA breakeven in 2024.

CloudBees is a software company that specializes in providing enterprise-level solutions for software development, mainly focusing on DevOps and continuous integration/continuous delivery (CI/CD) processes.

When we invested: We invested in November 2021.

Why we invested: Our CIOs liked the solutions and signaled growing demand for CI/CD in enterprises. Autodesk, Capital One, HSBC, Fidelity Investments, and other enterprises have been clients for a decade. We liked the vision for the holistic platform, the hybrid strategy of being both on-premise and in the cloud, and the growing market of DevOps. CloudBees has a very loyal fan community, with the founder still in charge of the product.

We liked the growth rates at near-profitability. We also expected that the company might fundraise soon, so we invested one week before the announcement of the round led by Goldman Sachs, realizing a 37% paper gain right away.

We liked the growth rates at near-profitability. We also expected that the company might fundraise soon, so we invested one week before the announcement of the round led by Goldman Sachs, realizing a 37% paper gain right away.

Round F happened in December 2021 at a 1.8x valuation step-up to our investment valuation. Since then, the company has grown its top-line revenue by 60% or at 20% p.a.

Our portfolio companies in the news

As seen in

Contacts

149 New Montgomery St., Ste. 616, San Francisco, CA 94103

© 2024 Traction Fund LLC

Join Traction

We use cookies to provide the best site experience.

Ok